Depending on the country where your organization is located, your administrative obligations once aan offline and online donation has been processed differ quite significantly. Nevertheless, if a Tax receipt and Thank You letter are part of your donor journey, they must not be overlooked as an opportunity to engage and reinforce your relationship with your supporters, and in turn, raise more funds.

Tax Receipts: The Basics

In France and Belgium, sending a tax receipt is mandatory (for donations after a certain amount) but in Italy, Sweden, Norway, Finland, United Kingdom, and Denmark, the requirements differ according to the organisation’s social mission, donation amount, etc.

In France and Belgium, sending a tax receipt is mandatory (for donations after a certain amount) but in Italy, Sweden, Norway, Finland, United Kingdom, and Denmark, the requirements differ according to the organisation’s social mission, donation amount, etc.

We will not go into details in this article given the complexity of the subject, instead, we will focus on how to integrate this into your fundraising strategy and when and how to take advantage of this point of contact with your donor single and monthly donors.

Let’s start with the organisations that are required to send a tax receipt.

Since the donation has been made online on one of your donation pages, it is important that you send a thank you email before sending the tax receipt.

With the iRaiser payment application, your thank you email will be sent automatically after a one-time donation. If you wish to enroll the donor in a specific email cycle, then you will need to use a marketing automation application.

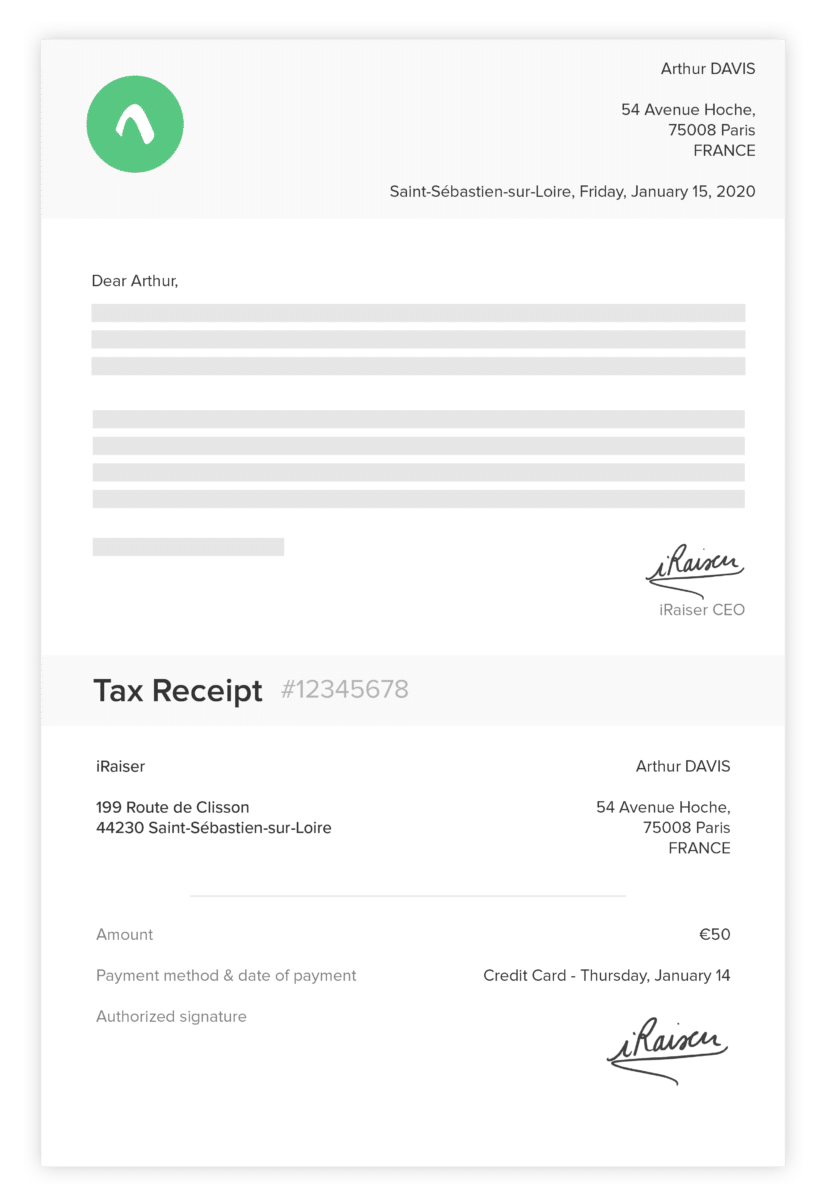

As for the tax receipt, it can be sent in different ways:

- By email as an attachment.

- It can be available in the donor space: you will need to send an email to your donor indicating how to access their donor account.

- Or through regular mail.

Whichever channel you choose, it is recommended that you send the tax receipt within 8 days of the donation or, at most, within 30 days. Many donors do not consider making a donation again until they have received their tax receipt, which means that this step is very important in the donor retention process!

If you only send tax receipts once a year, be sure to mention this in your thank you email.

This, of course, is not the case with recurring donations: the donor will receive his tax receipt once the year has ended and it will accumulate all the automatic debits made during the year.

For tax receipts mailed once a year, organisations should plan to mail them depending on where they are located:

- In Belgium: plan to send them no later than mid-February

- In France: give preference to March or April, or 1 to 2 months before sending your tax returns, in order to avoid your donors asking for reissues because of lost receipts.

Finally, it goes without saying, that in the case of your tax receipts, do not forget that it must include all the mandatory legal notices. Think of checking the following elements before sending: the sequence numbers, the receipts to be issued or not to be issued etc.

Also watch the size of the pdf you generate. To be sure that it is delivered in all your donors’ email boxes, your tax receipt in PDF format must be light (be careful with the format of the images, which can quickly make the document very heavy)

Now let’s look at the content.

Content: Adding Value for Continuous Engagement

Whether you have to send a thank you email and/or a tax receipt, the content must be carefully prepared and above all must have a financial objective which can be of 3 types:

Whether you have to send a thank you email and/or a tax receipt, the content must be carefully prepared and above all must have a financial objective which can be of 3 types:

- make your donors give more

- give again

- give differently.

Remember that using engaging content can take a less-than-exciting interaction and make it something that gets your supporter more interested, and more involved. You may include videos, moving stories about your organisation, and even impactful pictures can do the trick.

But it’s not just about what content you add, it’s also about how you present it. Instead of simply saying:

“Check out our latest blogpost! ”blog post! ", why not say: “Check out our amazing new photos on the field! Your generosity is changing lives!“

In the case of a recurring donor, take advantage of the tax receipt or the annual thank you email to ask for an increase in the amount of the direct debit. For example, if a donor gives you 10 euros per month, suggest they give 12 euros in the new year. Describe what a great impact just €2 more a month can have. Help them visualize where their money goes. The positive response rates are very good so don’t hesitate to ask for more!

If your donor has already increased the amount of their direct debit in the last 12 months, then propose they make an additional one-time donation.

In both cases, do not forget to attach a summary of the actions carried out by your organisation during the past year thanks to the donations received and your action plan for the coming year. Take this chance to thank them, and remind them why they care, to show what other ways they can help, or what their generosity has achieved.

In the case of a new donor, sending a thank you email or a tax receipt is not only an opportunity for the donor to get to know the organisation better, but also to discover how to support it in a different way. It is therefore the moment to propose the possibility of a monthly donation.

In addition to a video or presentation introducing the organisation, use moving messages to emphasize the importance of direct debit for your nonprofit, and propose a link to the regular donation form or peer to peer fundraising platform (or include a regular donation form in the mail if you prefer to send the tax receipt or thank you letter thank you letter or tax receipt by post).

Show Them Other Ways They Can Help

In the case a loyal donor has not responded to your proposals to switch to a recurring donation, then this may be a good time to talk to them about a legacy donation or personal fundraising pages depending on their age. If you wish to send a receipt or a thank-you note by mail, please do not hesitate to include a legacy leaflet in your mail or information about individual fundraising and personal fundraising pages.

For electronic mailings, you can send a link to the page dedicated to legacy donations or to the personal fundraising pages on your site. Once again, don’t forget to highlight the actions carried out by your nonprofit with the help of their donations, before evoking these other methods of giving.

In the case of a donor who has made a gift to support a friend or relative (through a P2P peer to peer fundraising campaign), there is no need to overdo it. A simple thank you email and/or the sending of the tax receipt and a link pointing to your activities is enough. As this type of donor may not be very likely to donate directly to your organisation, you can also propose that they in turn, launch a P2P action peer to peer campaign of their own in your support.

Last but not least, in the case of major donors, a personalized email or better, a letter signed by the president or the general manager (in addition to a phone call) in a completely non-marketed way is a must, accompanied by a review of your actions of the year but without additional solicitation.

A Simple Thank You Goes A Long Way

It’s not just about saying Thank You, but how you say it. The main purpose of a Thank You letter is to make your donor feel good about their decision to give to your nonprofit, and to show that they are actually making a difference. Ask yourself, “Does it make me feel anything?”. If it’s not the case, you need to rethink your Thank You messages.

Personalizing your emails (mentioning the name of your donor, his donation amount, etc) and adding a human touch (signed by one of your employees and providing contact info) creates a real-person feel and connection.

Show them as well what their donations achieve with moving content (why not a personalized video?) as we mentioned earlier. Above all, celebrate your supporters, for the work they’ve already helped achieve through their generosity. All this assures them they have made the right choice, and will help build create a long-lasting relationship.

Wondering how else to improve your fundraising? Find out how to integrate tax receipts into your regular giving strategy, read iRaiser's article: tips for an effective fegular giving strategy.